03 Jul, 2024

Gold Price, Analysis, and Chart

- Gold prices ticked higher in Europe and Asia

- Geopolitics continue to underpin the market

- The near-term uptrend is under some pressure

You can download our brand new Q3 Gold Forecast below:

Gold prices rose on Wednesday as the latest speech from Federal Reserve Chair Jerome Powell fed hopes that the next interest-rate move will be a cut, even if the timing remains uncertain.

Speaking on Tuesday Powell said efforts to reduce price pressures had gone well, putting the United States on a ‘deflationary path.’ However, he said the Fed needs more proof. At present the markets think the central bank will have seen enough by September to start cutting rates. But it’s far from sure.

Still, the prospect of a move offers gold support. Lower yields help assets like gold which lack intrinsic yield of their own. Beyond monetary policy , bulls can point to many supporting factors for the market. Geopolitical hotspots, from conflict in Ukraine and Gaza through to the crowded, uncertain global election procession are both playing their part. The latter has already produced shocks in France. It may do so this week in the United Kingdom.

Then there’s sustained central bank gold buying and ongoing signs of firm Asian investment demand.

Still, the market has handed back few of its hefty 2024 gains, and the prospect of weaker inflation across developed economies may leave gold prices more vulnerable. Plenty of speculative buying in both the physical and paper gold markets seen in the last two years will have been on the back of gold’s perceived role as an inflation hedge.

The coming session offers US Purchasing Managers index numbers and the release of minutes from the Fed’s last policy meeting as likely market movers.

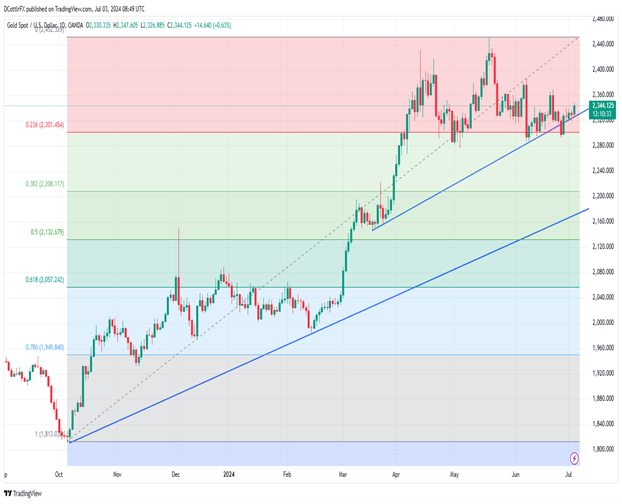

Gold Prices Technical Analysis

Daily Chart Compiled UsingTradingView

Gold has had an astonishing run this year, hitting an all-time high of $2,450 at the start of May.

Now progress has slowed. Of course, prices haven’t fallen far and the uptrend from last October’s lows remains both in place and, importantly, completely unthreatened. However, the nearer-term trendline from mid-March is very much in focus. It has already given way once, but the market very quickly traded back above it, if not by much.

That line now offers the market near-term support just above an important retracement prop at £2,301.45.

A durable slide below that might not find much solid ground ahead of the $2,200 region which was the base of the sharp, speculative climb seen in April.

Of course, this market can still consolidate much further below that all-time high and still remain above any number of longer-term uptrends. But it also has the feel of a market that still looks a little frothy after such sharp rises. In short, the bulls probably have more to prove at this point, and traders should be wary of the clear prospect of some deeper falls.