07 Jul, 2024

Gold Q3 Fundamental Forecast

Gold is currently trading around $1,900 per ounce, approximately $100 higher than its opening level in the second quarter of 2024, having reached a new all-time high in mid-May. The global interest rate environment has seen anticipated rate cuts fail to materialize, particularly in the United States, as inflation persists above the forecasts of various central banks. Central bank purchases, especially from China, have shifted the supply-demand balance in favour of higher prices. However, any pullback in demand could leave gold vulnerable to downside pressure. Additionally, the political risk premium that had supported gold has diminished, although it may resurface at any moment, especially with several high-profile elections on the horizon. Gold traders will have numerous factors to monitor closely in the third quarter.

Delays in US Interest Rate Cuts

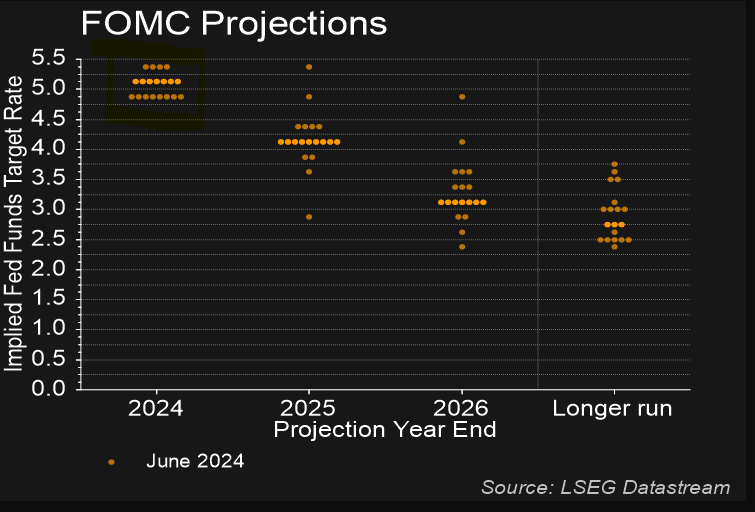

At the beginning of 2024, financial markets were anticipating between four and five 25-basis-point rate cuts by the Federal Reserve, with the first move expected in the second quarter. These forecasts have been revised significantly lower over the past few months, currently projecting one or, more likely, two rate cuts starting at the November Federal Open Market Committee (FOMC) meeting. This aligns with the latest FOMC year-end projections.

With US interest rates remaining elevated, the opportunity cost of holding non-yielding assets like gold increases. Interest-bearing investments such as bonds become relatively more attractive because they can generate income through interest payments. As a result, investors may choose to shift their capital away from gold and toward assets that can provide a yield or return based on the prevailing interest rates.

At the beginning of 2024, interest-rate sensitive US 2-year Treasuries traded with a yield around 4.25% as a series of rate predictions were priced in. In May this year, the same Treasuries offered a yield more than 5%, pulling gold lower. The longer US Treasury yields remain elevated, the more they will weigh on the price of gold.

Central Bank Demand for Gold

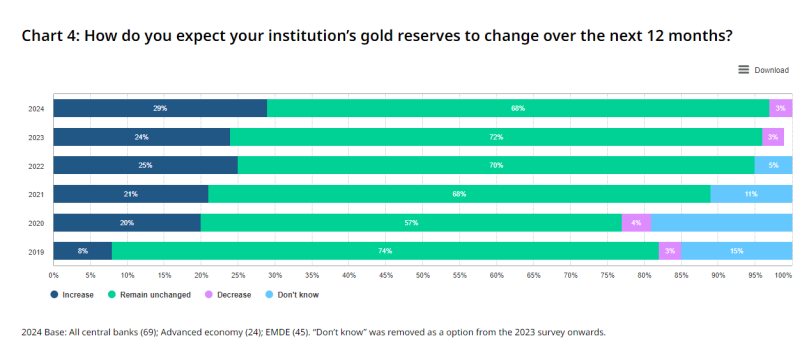

In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022, according to the World Gold Council. According to their 2024 Central Bank Gold Reserves survey – conducted between 19 February and 30 April 2024 with a total of 70 responses – 29% of central banks respondents intend to increase their gold reserves in the next twelve months, ‘the highest level we have observed since we began this survey in 2018.’ The survey noted that the planned purchases are motivated ‘by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation.’ These planned purchases should underpin the price of gold in the medium-term, counterbalancing the higher-for-longer interest rate backdrop.

Potential Market Impact of Upcoming Elections

The second half of 2024 will witness a series of significant general elections across the globe, including a potential rematch between incumbent President Joe Biden and former President Donald Trump in the United States. This election is expected to be highly contentious, and the lead-up to the November 5th vote is likely to contribute to increased market volatility. The previous presidential election was closely contested, with Donald Trump alleging voter fraud as the reason for his loss, while both parties this year have expressed concerns about foreign interference and media bias. Monitoring the events surrounding this year’s election will be crucial.

In addition to the U.S. election, snap elections have been called in France and the United Kingdom. In the U.K., the Labour Party is poised to assume control of 10 Downing Street for the first time in 14 years, while in France, the far-right is expected to gain power after making significant gains in the recent European elections.

Geopolitical Risks and Safe-Haven Demand

Beyond general elections, ongoing global conflicts in Ukraine, Gaza, and the broader Middle East continue to pose risks. Each of these conflicts has the potential to escalate at any time, potentially increasing demand for gold as a safe-haven asset.