17 Jul, 2024

USD/JPY News and Analysis

- Further intervention suspected amid fresh bout of solid yen appreciation

- BoJ to weigh a potential hike at the end of the month as markets eye September for the Fed’s first cut

- USD/JPY remains fraught with uncertainty but the magnitude and frequency of recent suspected intervention could keep USD /JPY largely rangebound

Yesterday’s report highlighted the drastic and sudden appreciation in the yen towards the end of last week which sent USD/JPY sharply lower – a theme that has continued this week, especially after today’s surge lower which has some parts of the market suspecting another smaller bout of FX intervention.

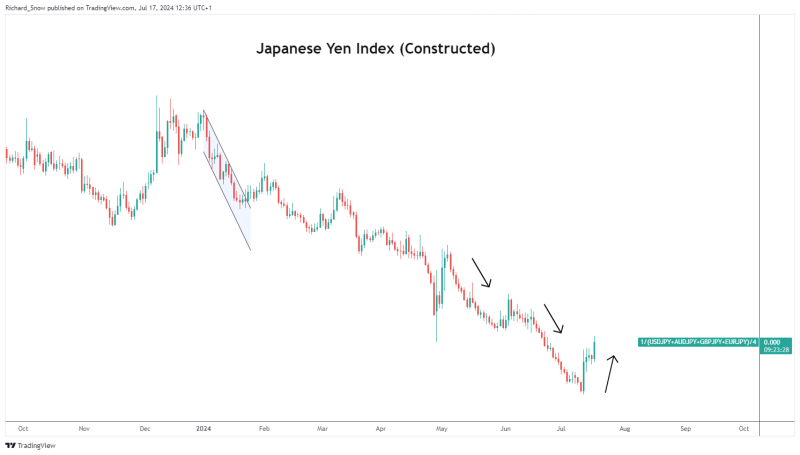

The Japanese Index below is a simple construction applying an equal weighting to the more commonly traded currency pairs, providing an indication of yen performance. The recent move higher has disturbed the otherwise steady downtrend – hinting at large scale yen purchases by Japanese officials, potentially.

Officials have preferred not to comment on questions around possible efforts to strengthen the local currency, hoping to dissuade speculators betting on a weaker yen.

Richard Snow

Despite mass yen purchases, Japanese currency officials have been unable to stop the yen’s decline which is more of a structural issue that appears via a large interest rate differential that remains in place to this day. The BoJ hiked earlier this year to pull interest rates out of negative territory but this did very little to overcome the massive gap between near zero rates in Japan and 5.25% in the US.

Today’s notable drop in USD/JPY has raised speculation of another round of yen purchases from Tokyo. After trading comfortably above 160.00, the pair now looks to 155.00 as the next level of support with 151.90 following thereafter.

Tokyo officials are hoping that the recent dollar decline can help extend the move lower in USD/JPY after lower US inflation has brightened the mood within the Fed’s ranks. Jerome Powell is encouraged by recent data and is looking for more of the same to achieve the necessary confidence to make that all important call to cut rates. Markets now fully price in a 25 basis point cut from the Fed in September – seeing the greenback depreciate against its peers.

The outlook for the yen remains precarious as it appears the strategy to keep the yen supported may have shifter to smaller, more frequent purchases instead of a massive, single transaction to sell dollars for yen. This is, of course, provided the recent volatility can be verified to have come at the instruction of Japan’s currency officials.