19 Jul, 2024

Gold (XAU/USD) – Recent Sell-off May Open Up Opportunities

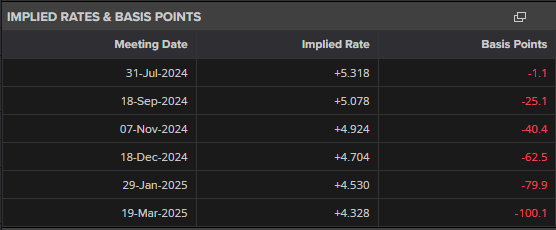

- The Fed will cut interest rates by 25 basis points at least twice this year.

- Any further move lower will likely bring buyers back.

Gold posted a fresh multi-decade high earlier this week, breaking out of a range that has held since late March. A break above the 20-day and 50-day moving averages at the start of the month allowed the precious metal to test and then break the mid-May high. The sell-off in the second half of this week has no real fundamental driver and any further move lower is likely to attract buyers back into the market. The US interest rate space looks positive for gold with two, and potentially three, quarter-point rate cuts now priced into the market. The first cut is fully expected at the September 18th FOMC , which coincides with the release of the latest Summary of Economic Projections.

Gold is trading on either of $2,400/oz. and any further sell-off is likely to be limited. Prior areas of resistance turned support between $2,350/oz. and $2,370/oz. also include the short- and medium-term smas and these should hold and add an extra layer of support.

Gold Daily Price Chart

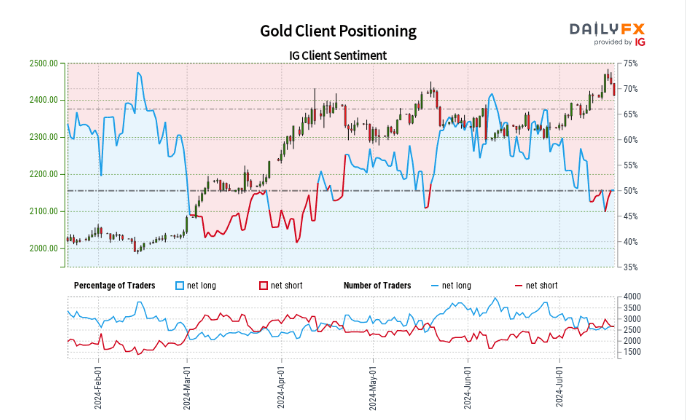

Client Sentiment is Bearish

Retail trader data shows 52.21% of traders are net-long with the ratio of traders long to short at 1.09 to 1.The number of traders net-long is 2.65% lower than yesterday and 1.64% higher from last week, while the number of traders net-short is 11.07% lower than yesterday and 7.53% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.