13 Mar, 2024

USD/JPY FORECAST

- USD/JPY rallies on Tuesday after a poor performance over the past few trading sessions

- Hotter-than-expected U.S. consumer price index data reinforces the U.S. dollar ’s rebound

- For greater clarity on the inflation outlook, traders should watch the upcoming PPI report

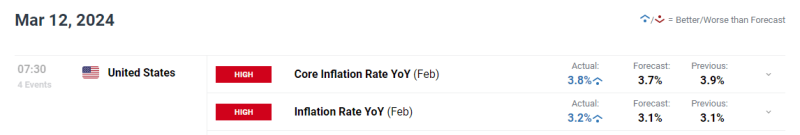

USD / JPY , already on an upward trajectory Tuesday morning, accelerated higher after February’s U.S. consumer price index figures surpassed projections, an event that boosted U.S. Treasury yields across the curve. For context, both headline and core CPI beat forecasts, with the former coming in at 3.2% y-o-y and the latter at 3.8% y-o-y, one-tenth of a percent above estimates in both instances.

US INFLATION DATA

Source: Economic Calendar

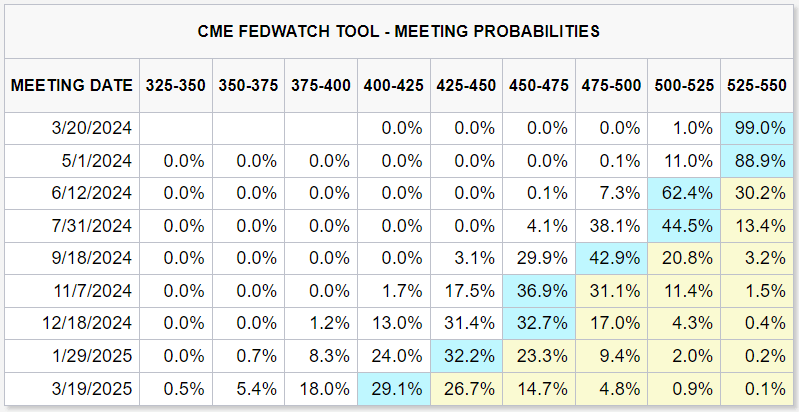

While Tuesday’s data failed to materially alter the odds of the first FOMC rate cut arriving in June, the report unearthed a troubling revelation: inflationary pressures are proving highly resistant and are running well above pre- Covid trends. This will not give the Fed the confidence it necessitates to begin policy easing. Markets may not agree with this assessment right now, but they have been wrong many times.

Eager to gain clarity on the U.S. dollar’s future trajectory? Access our quarterly forecast for expert insights. Secure your free copy now!

FOMC MEETING PROBABILITIES

Source: CME Group

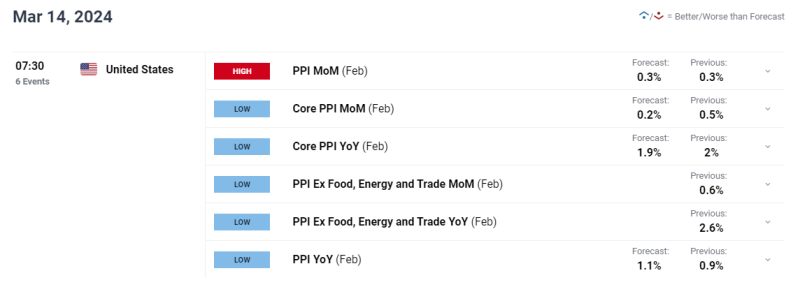

For further clarity on the outlook for consumer prices, it is important to keep an eye on Thursday’s PPI numbers. Another upside surprise like today’s could be the wake-up call Wall Street needs to recognize it has been underestimating inflation risks. This could fuel a hawkish repricing of interest rate expectations, propelling bond yields and the U.S. dollar upwards in the process.

Source: Economic Calendar

Curious about what lies ahead for USD/JPY? Find comprehensive answers in our quarterly trading forecast. Claim your free copy now!

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY rebounded on Tuesday, pushing past resistance around the 147.50 level. If this breakout is confirmed on the daily candle, prices could start consolidating higher over the coming days, setting the stage for a possible move toward 148.90. On further strength, the spotlight will be on 149.70.

On the other hand, if sellers return and drive the exchange rate back below 147.50, the pair could slowly head back towards confluence support spanning from 146.50 to 146.00. Below this technical zone, all eyes will be on the 145.00 handle.