19 Mar, 2024

Most Read: Gold Price Forecast: Fed in Spotlight – Bullish Explosion or Crash Ahead?

Gold prices advanced on Monday, but gains were limited in a context of market caution ahead of high-impact events in the coming sessions, including the FOMC announcement on Wednesday. In this context, XAU/ USD climbed approximately 0.2% in early afternoon trading in New York, bouncing off technical support located around the $2,150 region.

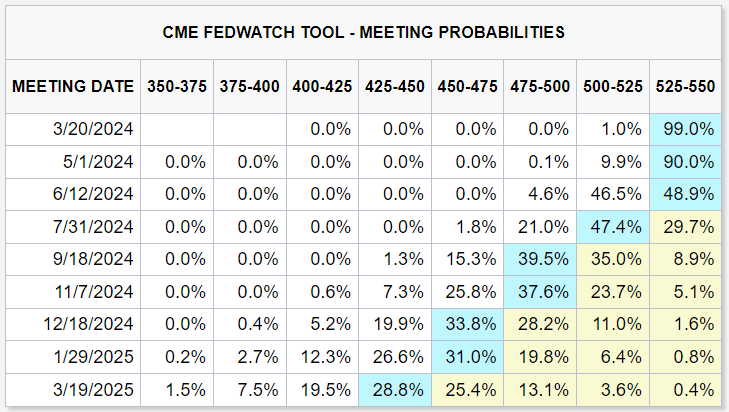

The Federal Reserve will hold its March meeting this week. Although the central bank is largely expected to keep its policy settings unchanged, the institution led by Jerome Powell could modify its forward guidance and adjust its outlook in the quarterly summary of economic projections in light of disappointing developments on the inflation front.

The upside surprise in the last two CPI and PPI reports highlight a concerning trend: progress on disinflation is stalling and possibly even reversing. For this reason, the Fed may opt for a more cautious approach, postponing the transition to a looser stance and reducing the scope of future easing measures. This could mean two quarter-point rate cuts in 2024 instead of the three envisioned earlier.

For an extensive analysis of gold’s fundamental and technical outlook, download our complimentary quarterly trading forecast now!

FOMC MEETING PROBABILITIES

Source: CME Group

If policymakers were to signal a less dovish roadmap and a delay in the easing cycle, U.S. Treasury yields and the U.S. dollar could shoot higher as Wall Street recalibrates interest rate expectations. This scenario could pose a threat to the current rally in precious metals and trigger a major downward correction in the space. This implies gold could be in a vulnerable position in the days ahead.

On the flip side, if the central bank adheres to its previous outlook and indicates it is not far from gaining greater confidence to finally begin reducing borrowing costs, gold may find itself in a more advantageous position to initiate its next leg higher. Upside inflation risks evident in recent data, however, suggests the dovish FOMC outcome is less likely to play out.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you are looking for—don’t miss out, get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | 7% | -7% | 0% |

| Weekly | 16% | -17% | -3% |

GOLD PRICE TECHNICAL ANALYSIS

Following a lackluster showing last week, gold prices found stability on Monday and successfully rebounded from support around the $2,150 mark. Should gains pick up traction in the coming days, trendline resistance at $2,175 could hinder further upside progress. However, if this barrier is breached, all eyes will be on the all-time high around $2,195.

Conversely, if bears mount a comeback and regain control of the market, the first technical floor to watch in the event of a pullback appears at $2,150. Bulls must vigorously defend this zone to thwart an escalation of selling pressure; failure to do so may usher in a drop towards $2,085. Subsequent losses beyond this point could shift focus to $2,065.