20 Mar, 2024

The Federal Reserve will release its March monetary policy announcement on Wednesday. Consensus estimates overwhelmingly suggest that the institution led by Jerome Powell will hold its benchmark rate unchanged at its current 5.25% to 5.50% range, effectively maintaining the status quo for the fifth consecutive meeting. Moreover, analysts widely anticipate that the central bank will keep its quantitative tightening program intact for now, continuing to reduce its bond holdings gradually.

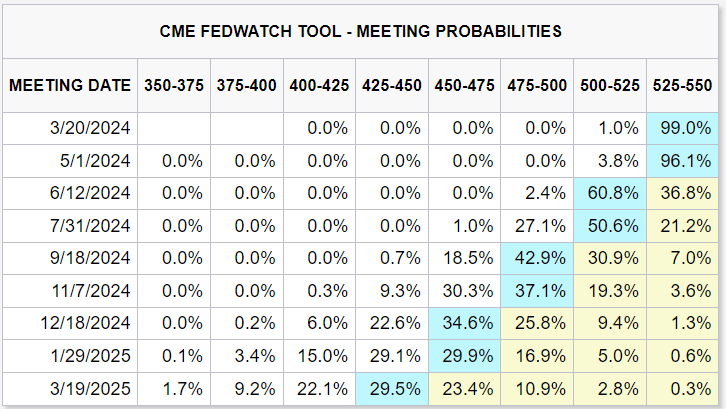

While the decision on interest rates themselves may not deliver dramatic surprises, markets will be laser-focused on the forward guidance. With that in mind, the FOMC may repeat that it does not expect it will be appropriate to reduce borrowing costs until it has gained greater confidence that inflation is converging sustainably toward 2 percent – a move that would indicate more evidence on disinflation is needed before pulling the trigger. Current FOMC meeting probabilities are shown below.

Source: CME Group

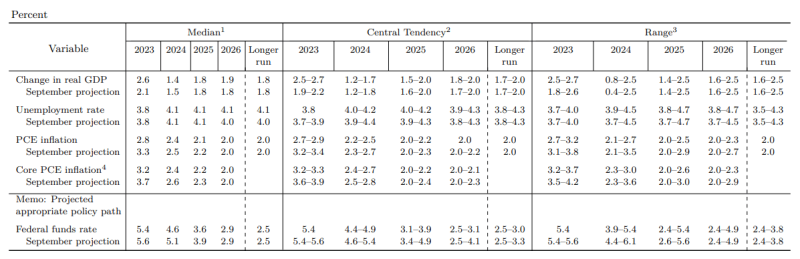

In terms of macroeconomic projections, the Fed is likely to mark up its gross domestic product and core PCE deflator forecasts for the year, reflecting economic resilience and sticky price pressures evidenced by the last two CPI and PPI reports . The revised outlook could compel policymakers to signal less monetary policy easing over the medium term , potentially scaling back the three rate cuts initially envisioned for 2024 to only two (this information will be available in the dot plot).

The following table shows projections from the December FOMC meeting.

For a complete overview of the U.S. dollar ’s technical and fundamental outlook, grab a copy of our free quarterly forecast!

Source: Federal Reserve

If the Federal Reserve signals a greater inclination to exercise patience before removing policy restraint and shows less willingness to deliver multiple rate cuts, we could see U.S. Treasury yields and the U.S. dollar charge upwards in the near term , extending their recent rebound. Meanwhile, stocks and gold , which have rallied strongly recently on the assumption that the central bank was on the cusp of pivoting to a looser stance, could be in for a rude awakening (bearish correction).