02 Apr, 2024

Market psychology can be a powerful force, often leading the retail crowd to follow the herd. However, experienced traders recognize the potential for profitable opportunities by going against the grain: doing the opposite of what most people are currently doing. Contrarian indicators, like IG client sentiment, offer insights into the market’s mood. Spotting moments of extreme bullishness or bearishness can signal potential turning points.

It’s important to remember that contrarian indicators are not infallible. For the highest probability trades, it’s crucial to integrate them into a broader trading strategy. By combining these insights with careful technical analysis and awareness of underlying fundamentals, traders can uncover hidden market forces and make more informed decisions. Let’s delve deeper by using IG client sentiment to illuminate the potential path for gold prices , AUD/USD , and NZD/USD .

Our second-quarter gold forecast is ready for download. Request the free trading guide now!

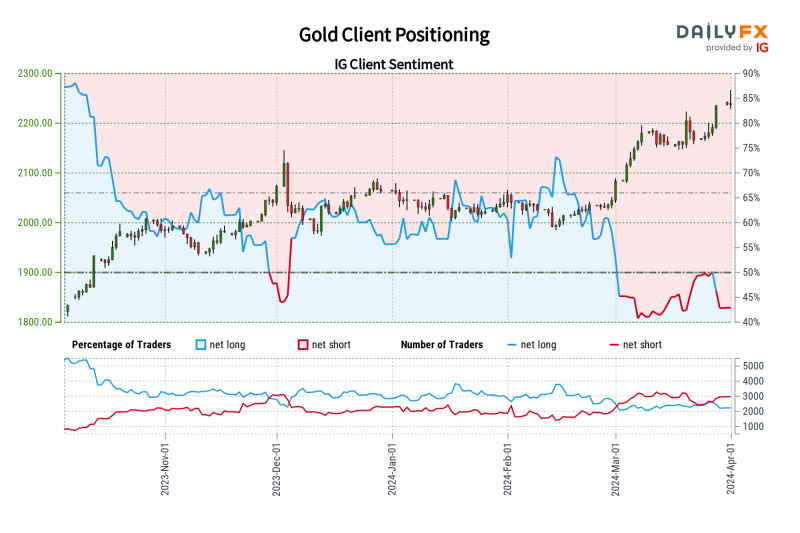

GOLD PRICE FORECAST – MARKET SENTIMENT

IG client data shows the retail crowd is betting against gold. Currently, 55.46% of traders hold net-short positions, resulting in a 1.25 to 1 short-to-long ratio. While this bearish positioning has remained largely unchanged since yesterday, it has increased by 6.15% from last week. Conversely, net-long positions have ticked up 4.14% since yesterday, even with a week-over-week decrease of 9.23%.

We often adopt a contrarian view of market sentiment. The predominantly bearish positioning could portend additional gains for the precious metal, meaning another all-time high could be in the cards before seeing any type of meaningful pullback.

Key Takeaway: When market sentiment leans heavily in one direction, contrarian cues can offer valuable insights. However, it’s crucial to integrate these signals with thorough technical and fundamental analysis when formulating any trading strategy.

Download our sentiment guide for valuable insights into how positioning may influence NZD / USD ’s trajectory!

| Change in | Longs | Shorts | OI |

| Daily | -4% | -9% | -5% |

| Weekly | 21% | -29% | 3% |

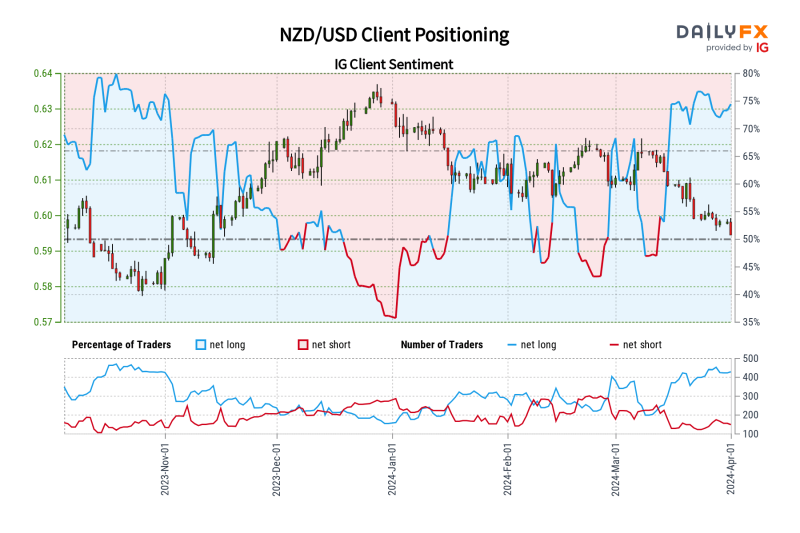

NZD/USD FORECAST – MARKET SENTIMENT

IG client data reveals a substantial 72.74% of traders hold net-long positions on NZD/USD, resulting in a long-to-short ratio of 2.67 to 1. The bullish conviction is on the rise, with net-long positions climbing 3.75% since yesterday and 2.78% compared to last week. However, short positions have also surged, increasing 10.67% from yesterday and a notable 28.68% from last week.

Our approach often diverges from prevailing market sentiment. The overwhelming optimism surrounding NZD/USD might imply that the recent pullback has not fully played out yet, hinting at further weakness ahead. This pessimistic stance is bolstered by the increasing prevalence of long positions among the retail crowd – a condition that’s reinforcing our bearish outlook on the pair.

Key Takeaway: When market sentiment is extremely one-sided, contrarian cues offer valuable insights. However, a well-rounded trading strategy always integrates these signals with thorough technical and fundamental analysis.

Unsure about the Australian dollar ’s longer-term trend? Gain clarity with our Q2 trading guide. Request the free forecast now!

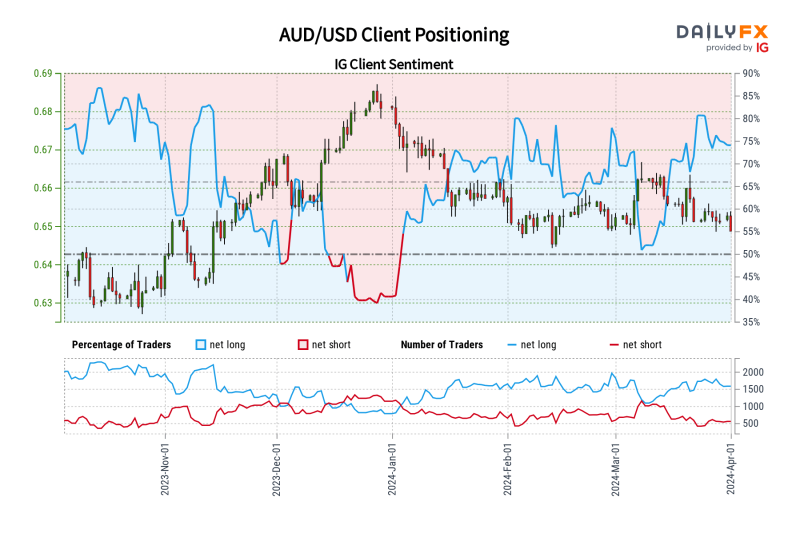

AUD/USD FORECAST – MARKET SENTIMENT

IG client data indicates a prevailing optimism among traders regarding AUD/USD’s prospects, with 75.92% holding bullish positions, resulting in a long-to-short ratio of 3.15 to 1. Interestingly, this bullish conviction has increased sharply with a 7.25% jump in net-long positions since yesterday, despite a minor 2.06% dip from last week. Meanwhile, net-short positions show a small decline since yesterday (3.72%) and negligible change week-over-week.

Our contrarian viewpoint towards market sentiment implies that the prevailing bullishness may hint at further declines for AUD/USD in the near term. That said, with the vast majority of traders anticipating an upward movement, we cannot rule out more pain on the horizon for the Australian dollar, heightening the likelihood of a move towards fresh multi-month lows below 0.6440.

Key Takeaway: When market sentiment leans heavily in one direction, it’s worth considering the opposite scenario. While contrarian signals are valuable, it’s always crucial to use them alongside in-depth technical and fundamental analysis for a comprehensive trading approach.