09 Apr, 2024

The U.S. dollar , as measured by the DXY index, traded moderately lower on Monday, but moves were measured amid market caution ahead of a high-impact event on Wednesday on the U.S. economic calendar that could bring increased volatility: the release of the March Consumer Price Index report.

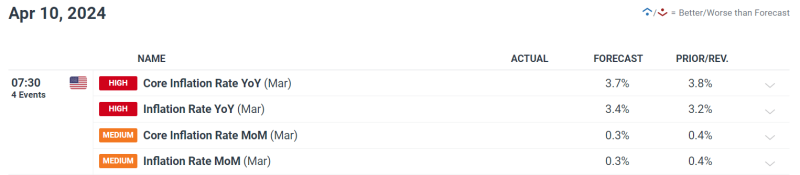

Consensus forecasts predict a 0.3% monthly increase in headline CPI, lifting the 12-month reading to 3.4% from 3.2% previously. The core CPI is also expected to rise 0.3% on a seasonally adjusted basis, though the annual rate is projected to slow slightly to 3.7%, a small step in the right direction.

Conflicting Fed Signals Add to Uncertainty

Comments from Fed Chair Jerome Powell last week indicate that the FOMC ‘s policy path has not materially changed, meaning 75 basis points of easing is still possible for this year. These remarks appear to have played against the greenback in recent days.

Although Powell is the most important voice at the U.S. central bank, other officials are beginning to express reservations about committing to a preset course. Governor Michelle Bowman, for example, has voiced concerns over the stagnation of disinflation efforts and is unwilling to slash borrowing costs until new signs of diminishing price pressures emerge.

Access a well-rounded view of the U.S. dollar’s outlook by securing your complimentary copy of the Q2 forecast!

Fed Dallas President Lorie Logan also seemed to have embraced a more aggressive posture, underscoring that it’s too early to entertain easing measures, pointing to sticky CPI readings and resilient demand as compelling factors supporting her viewpoints.

Taking everything into account, if the inflation outlook continues to deteriorate, the FOMC might find itself compelled to adopt a more hawkish position. With the labor market displaying remarkable strength, policymakers have sufficient leeway to exercise caution before moving towards a looser policy stance.

Inflation Report Will Dictate Dollar’s Direction

Traders should closely watch the upcoming CPI numbers and brace for potential volatility. That said, if the data surprises to the upside, U.S. Treasury yields could extend their recent advance, allowing the U.S. dollar to reassert its leadership in the FX space and resume its upward journey. With oil prices pushing towards multi-month highs, this scenario should not be ruled out.

On the flip side, if the CPI data falls short of what’s priced in, we could see a different reaction in the markets as traders boost bets of rate cuts. This could result in lower yields and a weaker U.S. dollar in the near term, especially if the magnitude of the miss is significant.

For a complete overview of the EUR/USD ’s technical and fundamental outlook, make sure to download our complimentary quarterly forecast!

EUR/USD TECHNICAL ANALYSIS

EUR / USD edged up on Monday, consolidating above both its 50-day and 200-day simple moving averages and nearing Fibonacci resistance at 1.0865. Bears will need to fiercely defend this technical ceiling; failure to do so could trigger a rally towards an important trendline at 1.0915, followed by 1.0980.

Alternatively, if sellers regain the upper hand and propel prices below the aforementioned moving averages, a retreat toward 1.0740 might occur. The pair is likely to stabilize in this region upon testing it, but in the event of a breakdown, a pullback towards the 1.0700 handle may be imminent.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Wondering how retail positioning can shape the near-term outlook for USD/JPY ? Our sentiment guide provides the answers you are looking for—don’t miss out, download the guide now!

| Change in | Longs | Shorts | OI |

| Daily | -11% | -3% | -4% |

| Weekly | -18% | -3% | -6% |

USD/JPY TECHNICAL ANALYSIS

USD/ JPY moved higher on Monday, tentatively approaching its 2024 highs established last month. Despite gains, the pair remains trapped within a narrow band of 152.00 to 150.90, a range it has maintained for the past couple of weeks, as seen in the daily chart below.

Traders seeking guidance on the pair’s near-term prospects are advised to monitor resistance at 152.00 and support at 150.90 attentively.

In the event of a bullish breakout, a potential rally towards the upper limit of a short-term ascending channel at 155.25 may unfold, contingent upon Tokyo refraining from intervening in currency markets to bolster the yen.

Conversely, if prices pivot lower and a breakdown eventually takes place, sellers might be enticed to re-enter the market, paving the way for a slide towards the 50-day simple moving average near 149.80. On further weakness, channel support at 148.80 would be the next area of interest.