02 Aug, 2024

NFP, USD, Yields and Gold Analysed

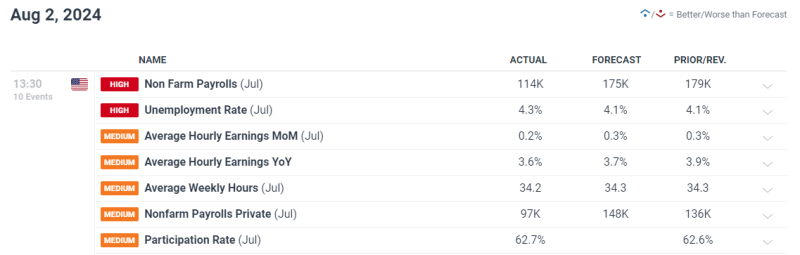

- A disappointing 114k jobs were added to the economy in July, less than the 175k expected and prior 179k in June.

- Average hourly earnings continue to ease but the unemployment rate rises to 4.3%

- USD continues to trend lower as do US treasuries while gold receives a boost

US Labour Market Shows Signs of Stress, Unemployment Rises to 4.3%

Non-farm payroll data for July disappointed to the downside as fewer hires were achieved in the month of June. The unemployment rate shot up to 4.3% after taking the reading above 4% just last month. Economists polled by Reuters had a maximum expectation of 4.2%, adding to the immediate shock factor and decline in the greenback.

Previously, the US job market has been hailed for its resilience, something that is coming under threat in the second half of the year as restrictive monetary policy appears to be having a stronger effect in the broader economy.

Indicators ahead of the July NFP number indicated that we may well see a lower number. The employment sub-index of the ISM manufacturing survey revealed a sharp drop from 49.3 to 43.4. The overall index, which gauges sentiment within the US manufacturing sector, slumped to 46.8 from 48.5 and an expectation of 48.8 – resulting in sub 50 readings for 20 of the past 21 months. However, the ISM services data on Monday is likely to carry more weight given the sector dominant make-up of the US economy.

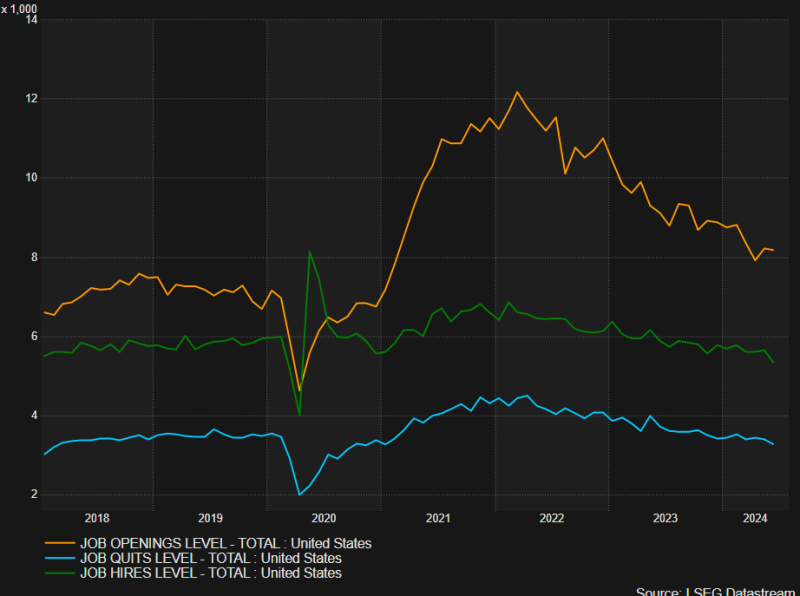

Additional signs of labour market weakness has been building over a long time, with job openings, job hires and the number of people voluntarily quitting their jobs declining in a gradual fashion.

What Does the Disappointing Jobs Data Mean for the Fed?

In the same week as the FOMC meeting, the disappointing jobs data feeds directly into the message communicated by Jerome Powell and the rest of the committee that there is a greater focus on the second part of the dual mandate, the employment side.

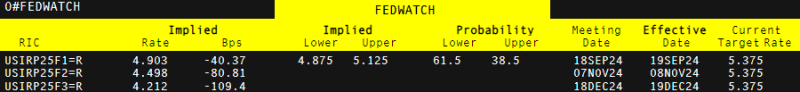

This has led to speculation that next month the Fed may even consider front loading the upcoming rate cut cycle with a 50-basis point cut to get the ball rolling. Markets currently assign an 80% chance to this outcome, but such enthusiasm may be priced lower after the dust settles as the Fed will want to avoid spooking the market.

Nevertheless, there is now an expectation for four 25-basis point cuts, or one 50 bps cut and two 25 bps cuts, before the end of the year. This view contrasts the single rate cut anticipated by the Fed according to their most recent dot plot in June.

Richard Snow

Market Reaction: USD, Yields and Gold

The US dollar has come under pressure as inflation continued to show signs of easing in recent months and rate cut expectations rose. The dollar eased lower ahead of the data but really accelerated lower in the moments after the release. With multiple rate cute potentially coming into play before the end of the year, the path of least resistance for the greenback is to the downside, with potential, shorter-term support at 103.00.

Unsurprisingly, US Treasury yields headed lower too, with the 10-year now trading comfortably below 4% and the 2-year just below the same marker.

Gold shot higher in the immediate aftermath of the data release but has recovered to levels witnessed before the announcement. Gold tends to move inversely to US yields and so the bearish continuation in treasury yields provides a launchpad for gold which may also benefit from the increased geopolitical uncertainty after Israel planned targeted attacks in Lebanon and Iran.