22 Apr, 2024

Following a brief surge in geopolitical tensions, traders may find relief in Iran’s decision not to further retaliate against Israel’s countermove, signaling a potential de-escalation in the Middle East and a return to focus on fundamental market drivers.

Curious about what lies ahead for the U.S. dollar ? Explore all the insights in our quarterly forecast!

Economic Data in the Spotlight

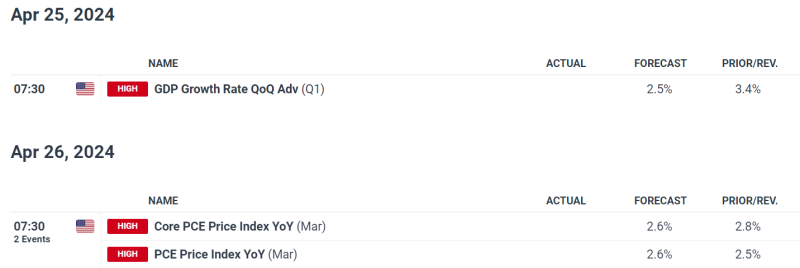

The upcoming week promises significant economic data releases that could sway market sentiment. Of particular interest are the US GDP for the first quarter and March’s core PCE data, a key inflation indicator for the Fed. Recent strong figures in retail sales, CPI, and PPI suggest that these reports could potentially exceed expectations.

Should the data prove hotter than anticipated, investors might conclude that the US economy remains resilient, and inflation is proving stubbornly persistent. This scenario could prompt a repricing of expectations, with traders betting on the Fed maintaining higher interest rates for longer and a shallower easing cycle than previously thought – a bullish outcome for U.S. yields and the U.S. dollar.

If you’re looking for a broader perspective on U.S. equity indices, make sure to download our Q2 stock market trading guide. It’s your gateway to a wealth of ideas and indispensable insights.

Earnings Season Heats Up

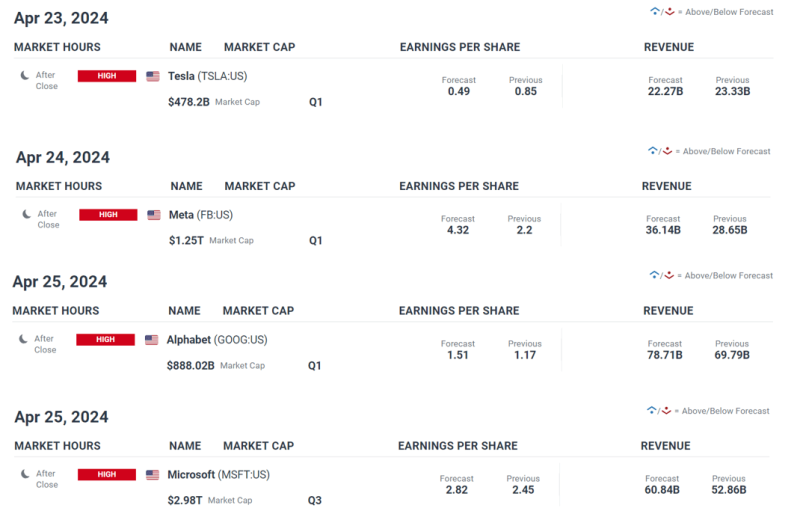

First-quarter earnings season marches on, with major tech companies slated to report their results. Tesla, Meta, Alphabet, Amazon, and Microsoft will offer insights into the corporate landscape. Strong earnings could lift market sentiment and bolster major indices, while disappointing results could raise concerns about economic challenges ahead.

Want to know where the Japanese yen may be headed? Explore all the insights available in our quarterly outlook. Request your complimentary guide today!

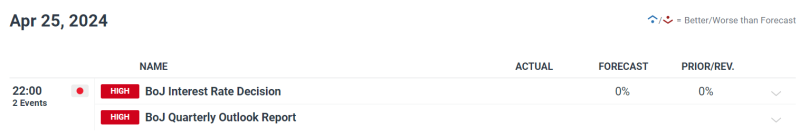

Central Bank Watch: Eyes on the BoJ

Central banks continue to command attention, with the Bank of Japan’s policy decision in the spotlight. Traders will closely analyze guidance for clues on the BoJ’s stance on rate hikes. If the bank indicates a lack of urgency for further increases, pressure on the Japanese yen could intensify. However, given the yen’s recent decline, the BoJ might adopt a slightly more hawkish stance to counteract currency weakness.

Key Takeaways

The coming week promises to be action-packed as traders navigate a mix of geopolitical developments, pivotal economic data releases, earnings reports, and central bank communications. Staying informed about these events will be crucial for traders looking to capitalize on market movements and manage their risk exposure.

For a comprehensive look at the variables that may affect financial markets and stir up volatility in the upcoming trading sessions, explore the meticulously curated assortment of critical forecasts provided by the team.

Gain access to an extensive analysis of gold ‘s fundamental and technical outlook. Download our quarterly forecast now!

FUNDAMENTAL AND TECHNICAL FORECASTS

British Pound Weekly Forecast: Lighter Data Week Could Mean Some Respite

The Pound is holding above 1.2400 but is under clear pressure and the bulls will have a fight on their hands to keep it above that psychologically important level this week.

Euro Weekly Forecast: Geopolitics and Heavyweight US Data Will Run EUR/USD Next Week

The European Central Bank has made it clear that interest rates are coming down, with the June meeting very much a live event, but the Middle East crisis and a slew of high US data will control EUR/USD next week.

Gold Weekly Forecast: XAU/USD Bull Trend Refuses to Quit

Gold trades higher, seemingly impervious to the dollar’s strength and elevated US yields. Buoyed by safe-haven appeal and central bank buying, XAU/ USD uptrend persists.

US Dollar Forecast: Markets Await US GDP & Core PCE – EUR/USD, USD/JPY, GBP/USD

This article focuses on the fundamental and technical outlook for the U.S. dollar across three key pairs: EUR /USD, USD/JPY and GBP/USD . In the piece, we also explore market sentiment and price action dynamics ahead of major U.S. economic releases in the coming week.