25 Apr, 2024

Japanese Yen (USD/JPY) Analysis

- The yen breaks into the danger zone ahead of the BoJ meeting

- USD/JPY breaches line in the sand

- BoJ Governor Ueda still sees trend inflation below target, will the updated forecast bring the inflation objective closer?

- Elevate your trading skills and gain a competitive edge. Get your hands on the Japanese yen Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

The Yen Breaks above the Danger Zone Ahead of the BoJ Meeting

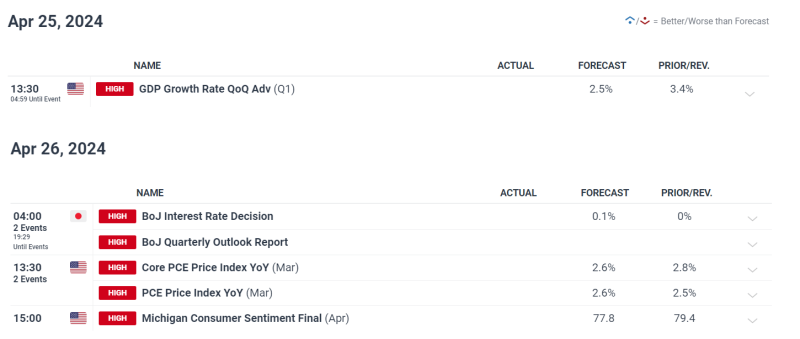

If US growth beats estimates and PCE reveals further setbacks to the disinflationary process, USD/JPY may accelerate even higher. The Atlanta Fed currently forecasts Q1 GDP at 2.7% while economists foresee growth of 2.5% for the first quarter.

The Bank of Japan (BoJ) will look to avoid a repeat of the dovish messaging issued in the run up to the 2022 FX intervention efforts that sent the yen reeling. In recent weeks, current BoJ Governor Kazuo Ueda has alluded to the potential of raising interest rates if underlying inflation continues to go up, but on Tuesday, he stressed that trend inflation remains somewhat below 2% which will turn the focus to the medium-term inflation projection which will accompany the BoJ statement as the two-day central bank meeting draws to a close tomorrow.

The yen has weakened across a number of major currencies in the last few days, adding pressure on Japanese authorities to respond to the consistent depreciations of the local currency. Japanese exports thrive on a weaker yen but at a certain point input costs like fuel become a drag on the economy, something Japan is looking to avoid – particularly at a time when oil prices are heading higher.

Japanese Yen Index (Equal-Weighted Approach)

USD/JPY Breaches ‘Line in the Sand’

USD/JPY at 155.00 has been in the works now for weeks and now that it has been breached – even before high impact US data has been released – currency markets appear unfazed. The upper side of the longer-term, ascending channel becomes the next level of resistance ahead of the 160.00 marker.

With the BoJ likely to keep rates unchanged, the only other obvious tools at Kazuo Ueda’s disposal is to taper asset purchases (or signal lower bond purchases) or to present a strong hawkish stance in his assessment of the overall situation. Either way, in the absence of action from the BoJ or finance officials, momentum appears to be heading higher for USD/JPY.

To the downside, things can move very quickly should action be taken by the ministry of finance. Prior intervention witnessed moves around 500 pips lower in USD/JPY as a reminder of how volatile the pair may become.

USD/JPY Weekly Chart

Learn the ins and outs of trading USD/JPY – a pair crucial to international trade and a well-known facilitator of the carry trade