29 Apr, 2024

EUR/USD and EUR/JPY Analysis and Charts

- EUR/USD took back some of Friday’s losses

- Bulls remain in charge, if not by a huge margin now

- Eurozone inflation numbers on Tuesday will be front and center for ECB-watchers

The Euro was higher against the United States Dollar on Monday despite a lack of obvious trading news, with bulls seemingly more confident above the 1.07 mark.

The single currency had been under pressure against a resurgent greenback this year as market watchers and economists pushed their forecasts as to when US interest rates might start to fall back to the second half of this year. Recall that, when 2024 got underway, a start date of March was thought possible.

However, the Euro has managed a notable bounce this month, as investors start to wonder whether this re-pricing could perhaps affect the European Central Bank as well. For now, the market is sticking to hopes that June could see the first reduction, but this is not yet a done deal and the inflation data seen between then and now from across the eurozone will be crucial.

The Eurozone’s official version for April is coming up on Tuesday, with economists looking for an annualized rise of 2.6%.

EUR/JPY was hit by strength in the Japanese Yen , which has moved sharply higher against the single currency and all other major rivals. Market participants suspect the Japanese authorities might be taking advantage of this week’s holiday-thinned domestic trade to kick back against what they’ve repeatedly suggested is the too-rapid depreciation of their currency. This morning’s USD/JPY foray to the 160.000 mark certainly saw brisk selling. Of course this may simply be some profit-taking. So far, the Japanese Finance Ministry has said nothing. But the market is on watch and EUR/JPY has fallen quickly form 171.00 to the 166.00 region.

EUR/ USD Technical Analysis

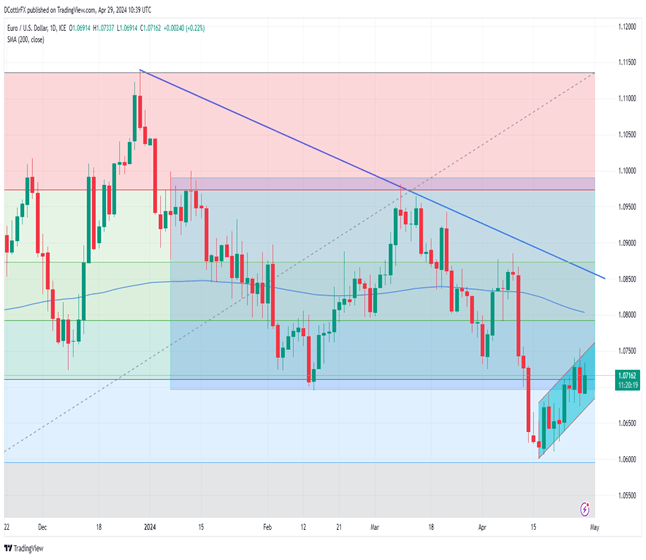

EUR/USD Daily Chart Compiled Using TradingView

The uptrend from April 16 remains very much in force, with Euro bulls trying to force their way back above retracement support at 1.07109, abandoned on April 12. So far, they have struggled to do this on a daily closing basis, but it seems likely that they will make it this week as long as that uptrend remains intact. Above that point there will be resistance at the current channel top (now 1.07473) ahead of the next retracement level at 1.07920 and the 200-day moving average (now 1.07990).

Reversals are likely to find support around the psychological 1.07 mark, ahead of the channel base at 1.06681.

IG’s own sentiment data finds traders quite evenly split about the Euro’s prospects from here. The bulls are still winning, but not by much, with 54% net long and expecting further gains.

| Change in | Longs | Shorts | OI |

| Daily | -15% | 16% | 2% |

| Weekly | 4% | 2% | 3% |