09 May, 2024

09 May,2024

Japanese Yen (USD/JPY) Analysis and Charts

- USD/JPY rises for a fourth straight session

- Official commentary out of Japan suggests more action to weaken it could come

- The US for its part has said intervention should be ‘rare’

USD /JPY has climbed to highs not seen for more than thirty years in 2024. This long rise finally prompted a multi-billion-dollar intervention in the foreign exchange market last week to knock it back from the Bank of Japan and the Ministry of Finance.

Tokyo argues that the Yen’s fall is disorderly, out of line with market fundamentals, and risks stoking more domestic inflation via an increase in exported goods’ prices.

For its part the United States seems unlikely to tolerate repeated interventions. Treasury Secretary Janet Yellen said last week that official action in the currency market should be ‘rare.’ The possibility of a spat between the two economic giants over the issue will keep traders very much on their toes when it comes to USD/JPY.

Despite the Bank of Japan’s historic step away from ultra-loose monetary policy this year, the Yen still offers miserable yields compared to the Dollar. It seems probable that those yields will get less miserable, perhaps in the quite near future. But the Dollar looks set to keep its monetary edge for some years, which makes a weaker Yen all but inevitable.

USD/JPY has not retried the dizzy heights above 158.00 scaled in late April before Tokyo stepped in with its billions. However, it remains above 155.00 and clearly biased higher.

The very best Japanese policymakers can hope for absent some reason to sell the Dollar more broadly is to slow the rise in USD/JPY.

Thursday saw the release of the Bank of Japan’s ‘summary of opinions’ from its April 26 rate-setting meet. Members discussed possible future rate hikes if Yen weakness persists and stokes imported inflation.

With so many moving parts in play for the Yen right now, it could be a volatile time for the currency and trading warily is advised.

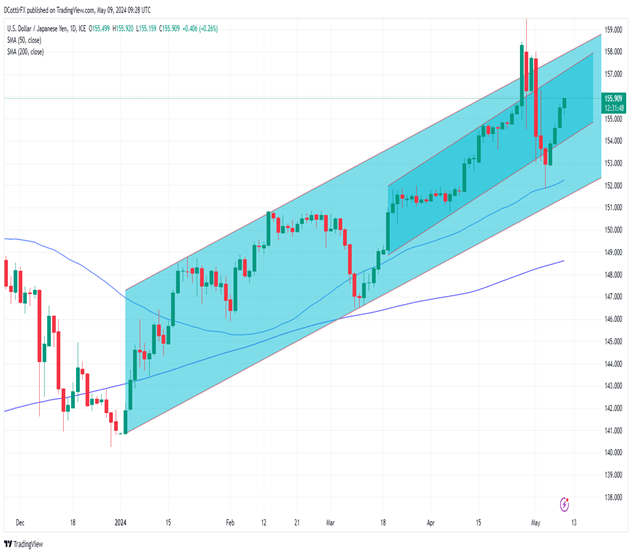

USD/JPY Technical Analysis

| Change in | Longs | Shorts | OI |

| Daily | 4% | -1% | 0% |

| Weekly | 6% | 2% | 3% |

USD/JPY Daily Chart Compiled Using TradingView

The pair has bounced back into a better-respected and possibly more meaningful uptrend band within its overall rising trend. This narrower band has so far been quickly traded back into whenever it has been abandoned and now offers support at 154.055, with resistance at the upper bound coming in at 157.263.

Of course, forays as high as that would seem to run the risk of meeting some Dollar selling from the Japanese authorities, at least in the short term.

Last Friday saw the Dollar bounce exactly at its 50-day simple moving average, support that could remain significant. It now lies at 152.25. Even a slide that far would keep the broader uptrend very much in place.

Retail traders seem to doubt that the Dollar can go much higher now, with a clear majority perhaps unsurprisingly bearish at current levels. This might indicate that Tokyo’s action is having at least some effect in slowing the Yen’s decline.