14 May, 2024

Gold, Silver Analysis

- Gold starts the week on the back foot with the US CPI the main focus

- Silver respects zone of resistance ahead of US CPI

- Gold market trading involves a thorough understanding of the fundamental factors that determine gold prices like demand and supply, as well as the effect of geopolitical tensions and war. Find out how to trade the safe haven metal by reading our comprehensive guide:

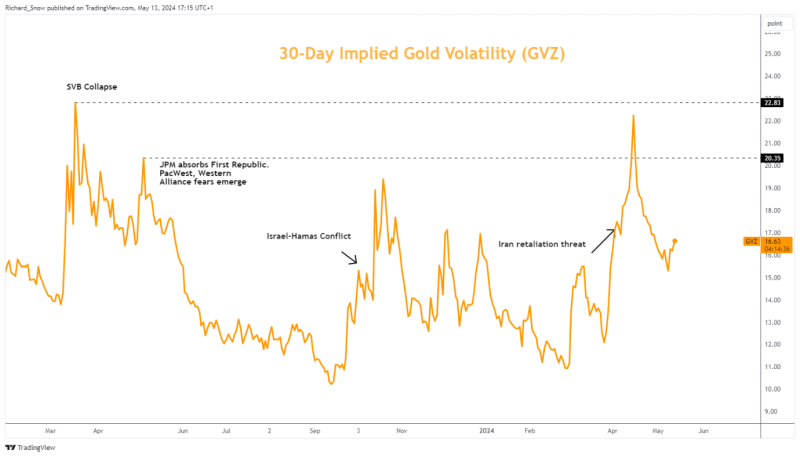

30-day implied volatility revealed a lift higher and still remains relatively elevated. Current levels, however, fall some way short of the panic which ensued when US regional banks got into trouble back in March 2023.

Gold Volatility (GVZ) Chart

Gold Starts the Week on the Back Foot with US CPI the Main Focus

Gold has witnessed a noticeable drop on the first trading day of the week – which isn’t all that surprising seeing that US CPI is due on Wednesday and Jerome Powell speaks on Tuesday. The precious metal appears to have tagged trendline resistance before pulling lower at the end of last week and continuing in that vein on Monday.

Since the recent all-time high, gold has largely pulled back as traders and investors weigh their next moves. US Data has softened, particularly the jobs market as NFP missed the estimate and last week’s initial jobless claims printed notably higher than prior figures. This provides a more dovish view of the dollar as upside potential appears limited in the event inflation eased in April. A lower dollar tends to support gold prices but gold has risen and declined in line with the dollar – in contrast to the usual inverse relationship observed between the two.

Should bears bring down gold prices from here, $2,319.50 presents the immediate level of support, followed by the swing low at $2,277. Upside targets appear at the resistance zone around $2,360 and trendline resistance.

Gold (XAU/ USD ) Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 7% | -1% | 4% |

| Weekly | 36% | -26% | 3% |

Silver Respects Zone of Resistance Ahead of US CPI

Silver, like gold, has enjoyed a longer-term bullish move and has also failed to retest the recent high. $28.40 proved to be a challenge for the most recent bullish advance as price action approached the zone late last week only to drop back beneath it. The zone emerged during the years of 2020 to 2021, where a consistent rejection of higher prices could be seen in the broader area.

The next level of significance to the downside emerges at the 78.6% Fibonacci retracement ($27.41), followed by the swing low at $26.00. The RSI also appears to have rounded, heading lower for now. Upside targets would require a new catalyst and US inflation may help it get there but early estimates assume cost pressures will show further signs of easing in April, which may weigh on the precious metal. Resistance remains at $28.40 with the all-time high of $29.80 requiring a substantial influence to tag the significant level.

Silver (XAG/USD) Daily Chart

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.