15 May, 2024

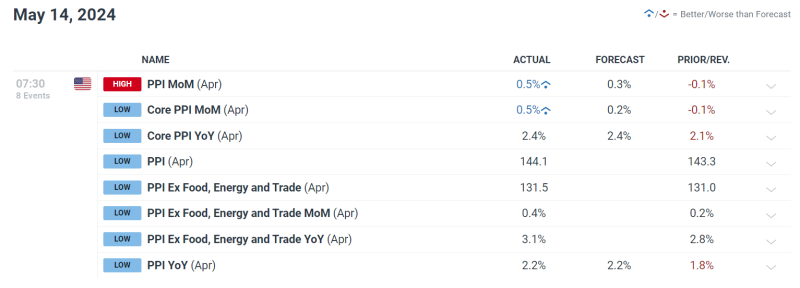

Gold prices rebounded on Tuesday, climbing nearly 0.8% and pushing past the $2,350 threshold after the previous day’s steep decline. This upward movement was fueled by a weaker U.S. dollar and subdued Treasury yields in the wake of the release of the latest batch of U.S. producer price index (PPI) information, which ultimately failed to ignite significant volatility.

While April’s PPI figures topped estimates, a downward revision from the previous month softened the impact. In addition, traders were reassured that the gains were primarily driven by portfolio management services, a sector with limited influence on the broader economy. Importantly, many PPI components that feed into the core PCE deflator saw only modest increases, suggesting that the disinflationary trend is not entirely dead.

Most Read: Gold, EUR/USD, USD/JPY – Price Action Analysis and Technical Outlook

PPI data often presents a mixed bag of signals, making it challenging to interpret. To get a clearer view of the inflation landscape, investors will be closely monitoring the upcoming CPI report due out on Wednesday morning. Both the headline and core indicators are seen rising 0.3% m-o-m, bringing the annual readings down to 3.4% from 3.5% for the former and to 3.7% from 3.8% for the latter.

Weaker-than-forecast CPI figures could rekindle hopes of disinflation, bolstering bets that the Fed’s first rate cut of the cycle would come in September – a probability currently pegged at around 50%. This scenario should be bullish for gold prices. Conversely, hotter-than-anticipated inflation numbers could send interest rate expectations in a hawkish direction, boosting the U.S. dollar and weighing on precious metals.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you are looking for—don’t miss out, get the guide now!

| Change in | Longs | Shorts | OI |

| Daily | 7% | -1% | 4% |

| Weekly | 36% | -26% | 3% |

GOLD PRICE TECHNICAL ANALYSIS

Following a sluggish start to the week, gold prices rebounded on Tuesday, reclaiming the $2,350 mark. Should gains accelerate in the upcoming trading sessions, the next technical obstacle lies near trendline resistance at $2,370. Clearing this barrier could fuel increased buying activity, setting the stage for a potential rally towards $2,420, and even $2,430.

In the event of a bearish reversal and dip below $2,350, there are no significant support zones nearby, suggesting that any downward movement could proceed relatively unimpeded toward $2,280 – the next relevant technical floor on the map. Further losses below this point could give way to a drop towards $2,260, a key area corresponding to the 38.2% Fibonacci level of the 2024 rally.