20 May, 2024

Last week, the U.S. dollar , as measured by the DXY index, experienced a sharp decline as softer-than-expected consumer price index figures reignited optimism that the disinflationary trend, which began in late 2023 but stalled earlier this year, has resumed.

Encouraging data on the inflation front fueled speculation that the Federal Reserve might ease its monetary policy sooner than anticipated, perhaps in the fall, propelling the euro and British pound to multi-month highs against the greenback. Precious metals also shone, with gold nearing its all-time high and silver reaching its strongest level since 2013.

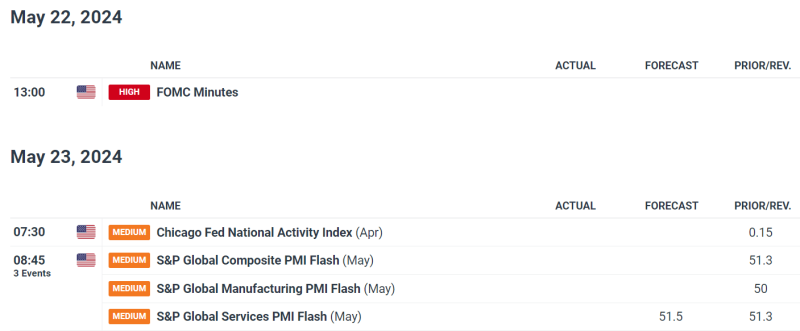

Looking ahead, the upcoming week presents a relatively light economic calendar, with the FOMC minutes and May S&P Global PMI results being the primary highlights. This muted schedule suggests that recent market moves may consolidate as investors await more significant catalysts.

For an extensive analysis of gold’s fundamental and technical outlook, download our complimentary quarterly trading forecast now!

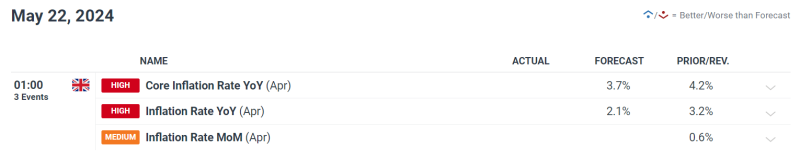

Across the pond, the economic calendar is similarly sparse, though the UK’s April inflation data, due on Wednesday, could be pivotal. A stronger-than-expected reading might decrease the likelihood of a Bank of England rate cut in June, while a subdued report could solidify expectations for such a cut.

Want to know where the British pound may be headed over the coming months? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

For a more in-depth analysis of the factors that could potentially impact financial markets in the coming week, be sure to check out the comprehensive forecasts and insights provided by the team. Their expert analysis can help you navigate the evolving market landscape and make informed trading decisions.

Curious about the euro’s near-term prospects? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

FUNDAMENTAL AND TECHNICAL FORECASTS

British Pound Weekly Forecast: Will Inflation Data Bring Sterling Down to Earth?

GBP/USD has gained on U.S. dollar weakness and doubts that the Bank of England will cut rates soon.

Euro Weekly Forecast: Lower Volume Ahead Likely to Snub the euro

The week ahead is notable for its lack of ‘high impact’ economic data and events. With this being the case, lower ensuing volatility tends to favor higher yielding currencies.

Gold, Silver Weekly Forecast: Gold Bid on Dollar Drop, ‘Silver Squeeze’ Returns

Precious metals are looking positive after softer CPI data shifted the focus to Fed rate cuts and silver surged on what appears to be a return of ‘meme stock’ mania.

USD/JPY Trade Setup: Awaiting Support Breakdown to Validate Bearish Outlook

This article analyzes a possible short setup in USD/JPY , examining key technical levels whose invalidation could create compelling opportunities for breakout and breakdown strategies.

US Dollar Forecast: Quiet Week May Signal Deeper Slide Ahead – EUR/USD, GBP/USD

The article examines the short-term outlook for the U.S. dollar, honing in on two key FX pairs: EUR/USD and GBP/ USD . The piece also provides analysis on recent price action dynamics and fundamental drivers.