29 May, 2024

British Pound (GBP/USD) – Analysis and Charts

- GBP remains above $1.27

- Still, momentum seems to be waning after an impressive run higher

- Can bulls keep the upper hand?

Sterling’s strength is perhaps a little puzzling given monetary policy position that ought possibly to favor the Dollar more. The latest look at shop-price inflation in the United Kingdom came from the British Retail Consortium’s May snapshot. That found inflation falling back to normal levels, with its 0.6% rise the weakest since November 2021.

This will leave an August interest-rate cut from the Bank of England still quite likely. Contrast this with the situation in the United States, where any reductions at all this year remain open questions, perhaps all the more so following news of upbeat consumer confidence on Tuesday.

Indeed, Minneapolis Federal Reserve President Neel Kashkari said he couldn’t rule that out while he didn’t expect rates to rise. However, he also said that borrowing costs could remain at their current level for an extended period. The Dollar might have benefitted more if Kashkari had been a voting member of the Open Markets Committee this year. His comments are also more hawkish than some other Fed speakers’ have been lately.

Still, the prospect of ‘higher for longer’ rates haunts the Dollar and should probably give bulls of other major currencies pause.

Apart from UK election news flow, Sterling traders haven’t got many domestic cues left to anticipate this week. German inflation numbers are coming up later, and there may be some spillover action into EUR/GBP should they spring a surprise.

However, the week’s main event will be US pricing figures in the Personal Income and Expenditure series. They’re coming up on Friday and markets know the Fed will be watching as closely as anyone.

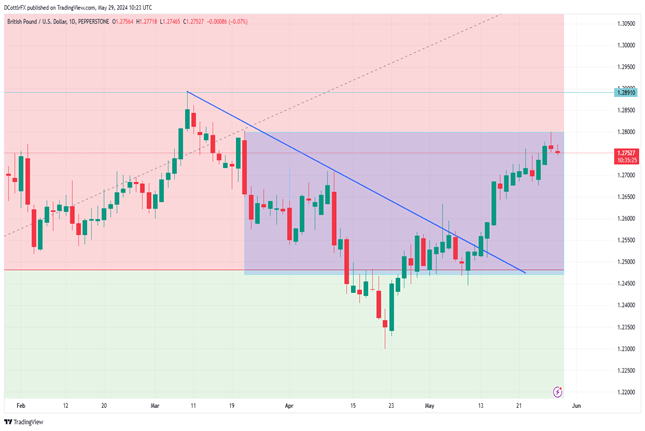

GBP/USD Technical Analysis

GBP/ USD Daily Chart Compiled Using TradingView

GBP’s impressive revival from the lows of late Apil has stalled at least for now at the highs of March 21. However, GBP/USD is unsurprisingly starting to look a little overbought judging by the stochastic oscillator. This may simply mean that some pause for consolidation is needed before a realistic assault on the recent highs can be made. If retracement is limited to the 1.2640 support region, then it may well mean another move higher. But matters could become more serious for the bulls if falls go much below that and put retracement support back into play.

IG’s data find traders happy to be short at current levels, but, again, this is likely to be in anticipation of some consolidation rather than a warning of heavy falls.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -11% | -8% |

| Weekly | -2% | -6% | -5% |