05 Jun, 2024

US Dollar Setups: (EUR/USD, AUD/USD, USD/CHF)

- A path for a lower dollar comes into view as data deteriorates

- EUR/USD in focus ahead of ECB cut

- Dollar bulls look for a lower AUD/USD as risk appetite wanes, iron ore prices ease

- Swiss franc advances at pace but overheating warnings flash red

A Path for a Lower USD Comes into View as Data Deteriorates

There’s been a notable decline in fortunes for the US as far as economic data is concerned. Economic growth has moderated and now looks unlikely to make a comeback after the Atlanta Fed’s GDPNow forecast revealed a massive turnaround in second quarter growth, from a prior 4+ percent to a measly 1.8%. The 1.8% projection is not much of an improvement from the Q1 print of 1.6% – which was a shocking print given the estimate anticipated 2.5% growth for the same period.

Source: Atlanta Federal Reserve Bank

Additionally, after analysing April’s CPI and PCE inflation data it would appear that the disinflation narrative is back on track, allowing the Fed to breathe a slight sigh of relief as it looks to pinpoint the most appropriate time to lower the interest rate.

In fact, as data trickles in we’re seeing an accumulation of weaker-than-expected hard data as well as ‘soft data’ like opinion surveys. The most recent being yesterday’s ISM manufacturing PMI survey which placed the sector further into contraction as the ‘new orders’ and ‘prices paid’ sub-indexes disappointed. The accumulation of softer data can be observed via the US economic surprise index which has continued the longer-term trend after dipping lower this week.

US Economic Surprise Index

Source: Refinitiv

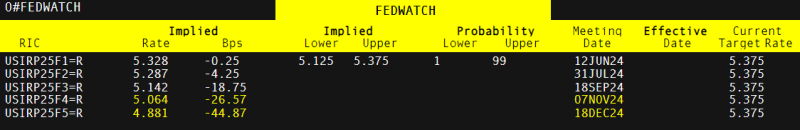

Markets still anticipate at least one rate cut this year with the possibility of a second. The difficulty lies in the timing of the meetings as the November tends not to attract any movement from the Fed in an elections year as a showing of its independence from the political arena. This leaves September and December as more likely dates for interest rate adjustments.

Market-Implied Basis Point Cuts into Year End

Source: Refinitiv

Are you new to FX trading? The team at DailyFX has curated a collection of guides to help you understand the key fundamentals of the FX market to accelerate your learning

EUR/USD in Focus Ahead of the Highly Anticipated Rate Cut

The ECB is gearing up to deliver its first rate cut after hiking borrowing rates at record pace to calm inflation. However, the market reaction after the event could be rather muted given numerous officials have targeted June as a preferable date to start lowering rates. Therefore, more attention is likely to be placed on the path of rate cuts to come but again, ECB officials have cautioned against a view that there will be rate cuts at successive meetings. Instead, a more measured approach has been communicated meaning there may not be a whole lot of new information this Thursday.

EUR / USD has risen off the back of softer US data, attempting a bullish breakout. This far conviction has been lacking. A test of channel resistance (now immediate support) could provide an indication if the move has the desired momentum to follow through. For a sustained move higher, US data needs to soften further, something that could be aided by a hawkish cut from the ECB – which is very tricky to pull off – but the committee will in all likelihood look to deliver a balanced and cautious message regarding further cuts.

EUR/USD downside has a number of challenges. First, the dollar shows little bullish impetus and secondly, markets have already priced in a 25 basis point cut in Europe and still the pair heads higher. Nevertheless, a return to 1.0800 and channel support remains a key area for bears.

EUR/USD Daily Chart

Source: TradingView

Swiss Franc Advances at Pace but Overheating Signals Flash Red

Continuing with bearish USD setups, USD/CHF provides another example for bears. USD/CHF has plummeted over the last three days, with today looking likely to extend the run. The 200-day simple moving average (SMA) presents an immediate threat to the recent momentum along with the RSI which has entered oversold territory. With this pair moving a long way within a short amount of time, it may be prudent to wait for better entries – something that the 200 SMA may provide if respected.

The Swiss franc has gathered strength after comments from the Swiss National Bank Chairman Thomas Jordan after he identified a weaker franc as a risk to the inflation outlook. The SNB were first to act out of the major developed central banks, cutting the interest rate in March already which left the currency to depreciate against G7 currencies.

USD/CHF Daily Chart

Source: TradingView

Dollar Bulls Eye Lower AUD/USD as Risk Appetite Wanes, Iron ore Prices Ease

In the event of a stronger USD, AUD /USD may provide a pair worth analysing. The Aussie dollar may soon run out of steam as risk appetite appears lackluster at the start of the week. The ‘high-beta’ currency preceded a lower start to the day for the S&P 500 – which it tends to be positively correlated to over time. This may be due to markets adopting a wait and see approach ahead of NFP data on Friday.

Metals have also struggled to find bullish momentum as gold , silver , copper and iron ore have all traded lower over the last couple of weeks. Iron ore is Australia’s main export which is typically destined for China. Worryingly, the economic powerhouse has revealed a lower appetite for the commodity as it seeks to recover from its own economic troubles.

AUD/USD failed to retest the recent swing high of 0.6714 and subsequently eased lower. The next test of downside potential rests at 0.6644 which previously capped the pair on numerous occasions. Thereafter, 0.6580 comes into view.

AUD/USD Daily Chart

Source: TradingView

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in AUD/USD’s positioning can act as key indicators for upcoming price movements.

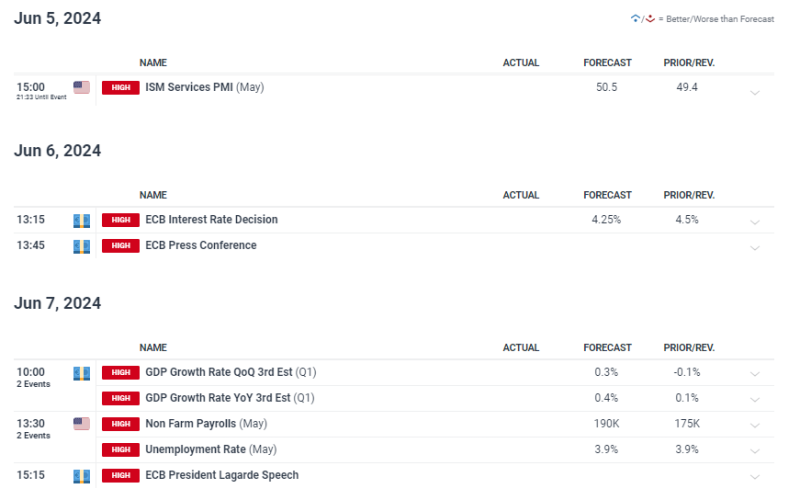

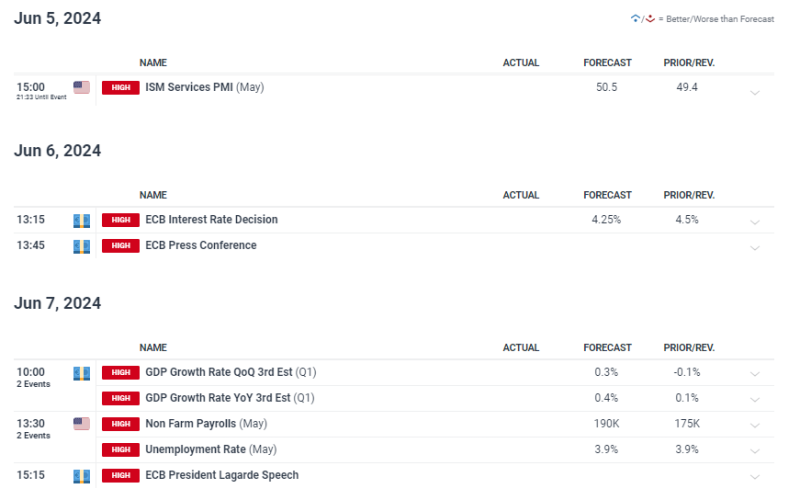

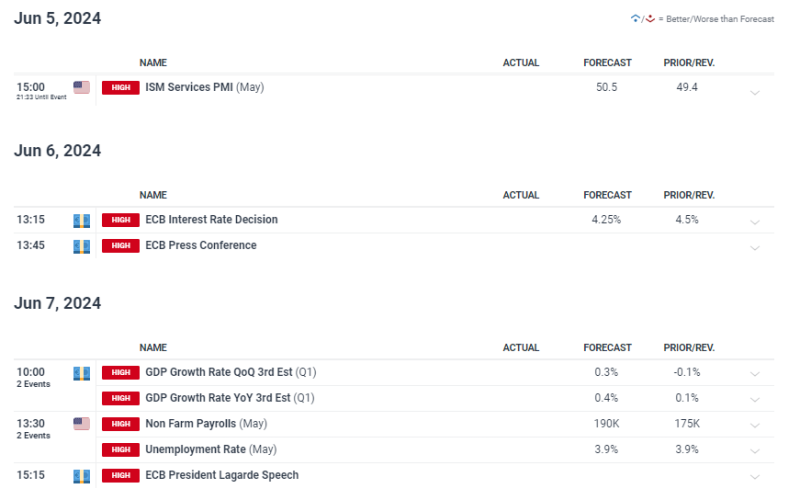

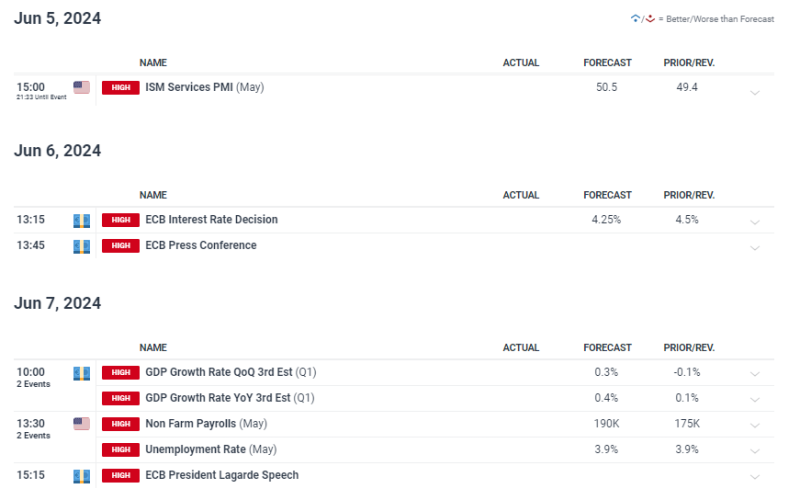

Major Risk Events Ahead

US services PMI will provide crucial insight into the sector contributing the most to US GDP. On Thursday we will hear from the ECB and most likely see the first rate cut. Friday is the main event however, with US NFP and average hourly earnings.